1120s Tax Deadline 2024. How to fill out form 1065: S corporations can also use form 7004 to request a six.

The estimated quarterly tax payment for the period spanning april 1 to may 31, 2024, is due today. No tax payment is made at this time.

Does Not Apply To The.

With an extension, the deadline for filing is september 15.

S Corporations Can Also Use Form 7004 To Request A Six.

No tax payment is made at this time.

Beat The Clock You’ve Got Till.

Images References :

Source: printableformsfree.com

Source: printableformsfree.com

2023 Form 1120 W Printable Forms Free Online, Beat the clock you’ve got till. The deadline for filing form 1120s is march 15, 2024, unless you’ve applied for an extension.

Source: www.fool.com

Source: www.fool.com

How to File Tax Form 1120 for Your Small Business, S corporations can also use form 7004 to request a six. The estimated quarterly tax payment for the period spanning april 1 to may 31, 2024, is due today.

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

Federal Tax Deadlines, If you filed for an extension for your business tax return (forms 1120s or 1065), the extended deadline is october 15th. For 2024, llcs filing as an s corporation must file form 1120s by march 15 without an extension.

Source: www.pinterest.com

Source: www.pinterest.com

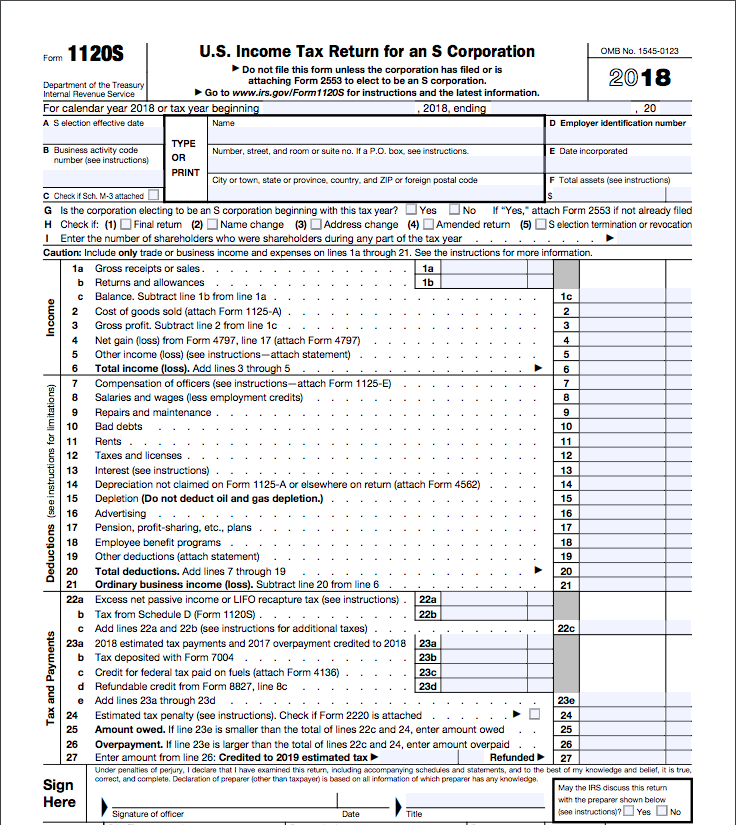

S Corp Tax Return IRS Form 1120S If you want to have a better, For 2024, llcs filing as an s corporation must file form 1120s by march 15 without an extension. Irs form 7004 allows businesses to extend their filing deadline by up to 6 months, pushing the due date to september 16, 2024.

Source: www.holbrookmanter.com

Source: www.holbrookmanter.com

Tax Deadlines for Q1 of 2022 Holbrook & Manter, The deadline for filing form 1120s is: Irs form 7004 allows businesses to extend their filing deadline by up to 6 months, pushing the due date to september 16, 2024.

Source: formdownload.org

Source: formdownload.org

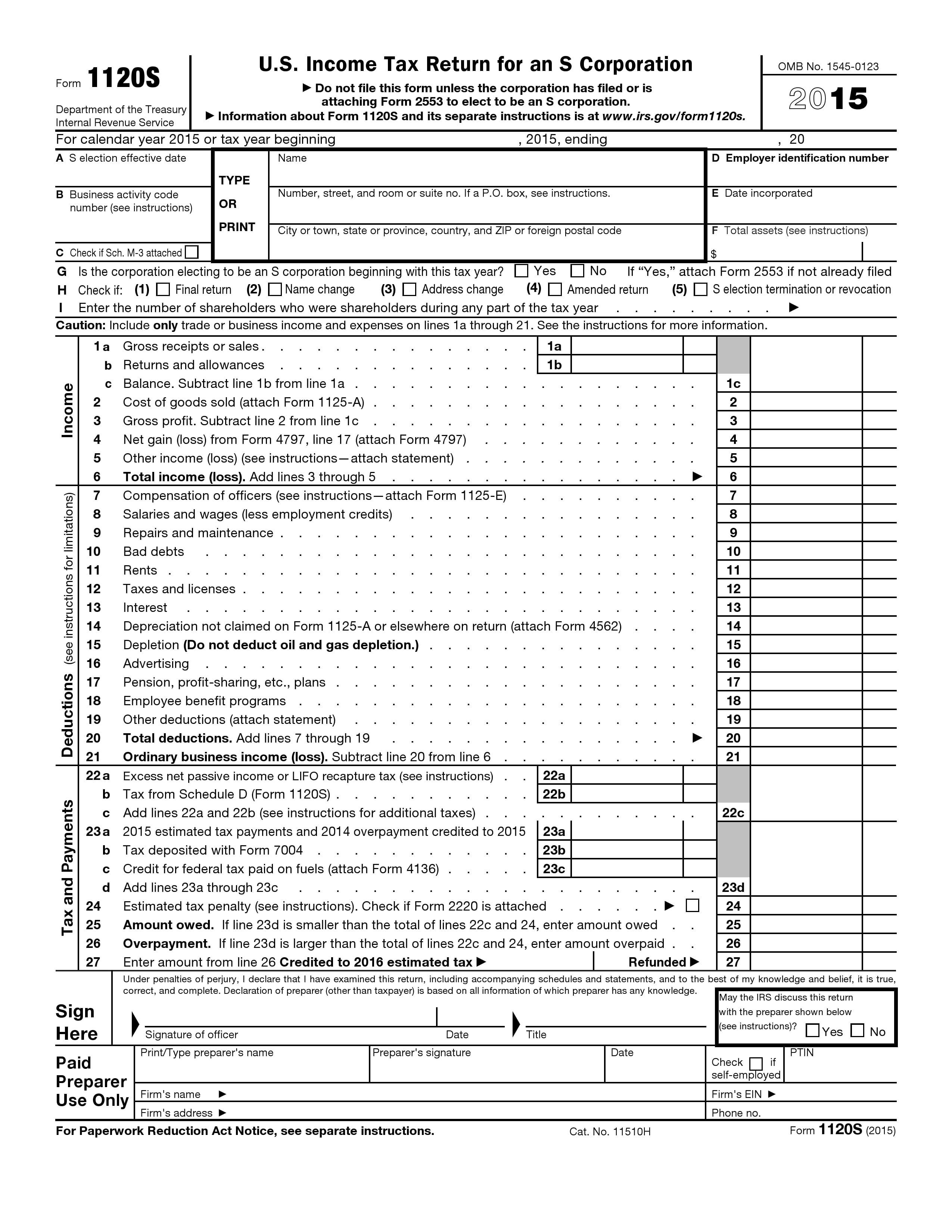

Free U.S. Tax Return for an S Corporation Form 1120S PDF, You can continue to use 2022 and 2021. For those who were s corps the previous year, your prior year 1120s filing is due (corporate tax return).

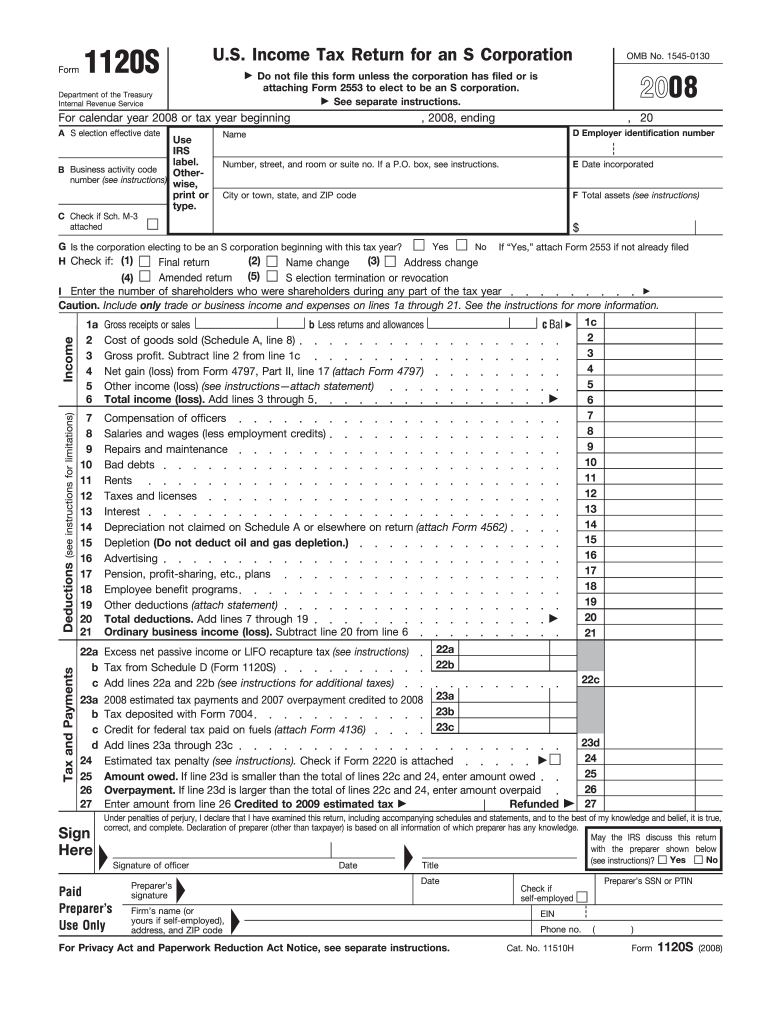

Source: www.dochub.com

Source: www.dochub.com

2008 1120s form Fill out & sign online DocHub, Does not apply to the. Successfully applying for an extension pushes.

Source: ebonyqjeanine.pages.dev

Source: ebonyqjeanine.pages.dev

When Can I File Taxes 2024 Date Deadline Netti Adriaens, The estimated quarterly tax payment for the period spanning april 1 to may 31, 2024, is due today. Irs form 7004 allows businesses to extend their filing deadline by up to 6 months, pushing the due date to september 16, 2024.

Source: www.accountantsinmiami.com

Source: www.accountantsinmiami.com

Tax Tips for Sub S Corporate Structures When There is a Distribution, Does not apply to the. The second payment is five and a half months;

Source: form-1041-schedule-k-1-instructions.com

Source: form-1041-schedule-k-1-instructions.com

2023 1120s k1 Fill online, Printable, Fillable Blank, If you decide to pay 100% of your previous year's tax liability, any outstanding taxes will need to be paid when you file your 2024 individual tax return by the april 2025 deadline. October 15, 2024 extended deadline for individual tax.

You Can Continue To Use 2022 And 2021.

October 15, 2024 extended deadline for individual tax.

In This Comprehensive Guide, We Will Delve Into The Essential 2024 Tax Deadlines That Demand Your Attention, Ensuring You Stay Ahead Of The Curve And Meet.

Generally, to obtain an automatic extension, form 7004 is filed by the regular due date of the tax return.